Best analytics service

Add your telegram channel for

- get advanced analytics

- get more advertisers

- find out the gender of subscriber

Kategoriya

Kanal joylashuvi va tili

auditoriya statistikasi Bitcoin ™️ | BTC | News

🚀Join us for the latest and most exciting updates in the world of Bitcoin🚀

Admin: @CryptoNewsAdminTG

Follow:

@EthereumNews

@AltcoinNews

@TradingNews

@MetaverseNews

@StockNews

Ko‘proq ko‘rsatish

267 4230

Obunachilar

~0

1 post qamrovi

~0

Bir oyda postlar

0

ERR

Obunachilarning jinsi

Kanalga qancha ayol va erkak obuna bo'lganligini bilib olishingiz mumkin.?%

?%

Obunachilar tili

Til bo'yicha kanal obunachilarining taqsimlanishini bilib olingKanal o'sishi

GrafikJadval

K

H

O

Y

Ma'lumotlar yuklanmoqda

Kanalda foydalanuvchining qolish muddati

Obunachilar sizning kanalingizda qancha vaqt turishini bilib oling.Obunachilarning ko'payishi

GrafikJadval

K

H

O

Y

Ma'lumotlar yuklanmoqda

Hourly Audience Growth

Ma'lumotlar yuklanmoqda

Time

Growth

Total

Events

STOP WAR IN UKRAINE!Message from the service Telemetrio

Since the beginning of the war, more than 2000 civilians have been killed by Russian missiles, according to official data. Help us protect Ukrainians from missiles - provide max military assisstance to Ukraine #Ukraine. #StandWithUkraine

Nusxalangan!

💰 Bitcoin futures open interest reaches new high at $38 billion

Open interest for bitcoin futures on centralized exchanges has reached a fresh high, indicating increased trading activity around the largest cryptocurrency by market capitalization. Since the start of 2024, daily open interest in bitcoin futures has increased by more than 100% from Jan 1, when it was approximately $17.2 billion. This rise coincides with bitcoin’s price surge to $70,000 — a 66% increase year-to-date.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

1 130

3

Nusxalangan!

💰 Spot bitcoin ETFs see fourth consecutive day of net inflows to end the month

Flows into spot bitcoin exchange-traded funds remained net positive on Thursday for the fourth consecutive day — closing the month on a strong note. The daily total net inflow for the spot bitcoin ETFs in the United States was $183 million as of March 28 — bringing the cumulative total net inflow to about $12.13 billion — according to data from SoSo Value.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

66 733

4

Nusxalangan!

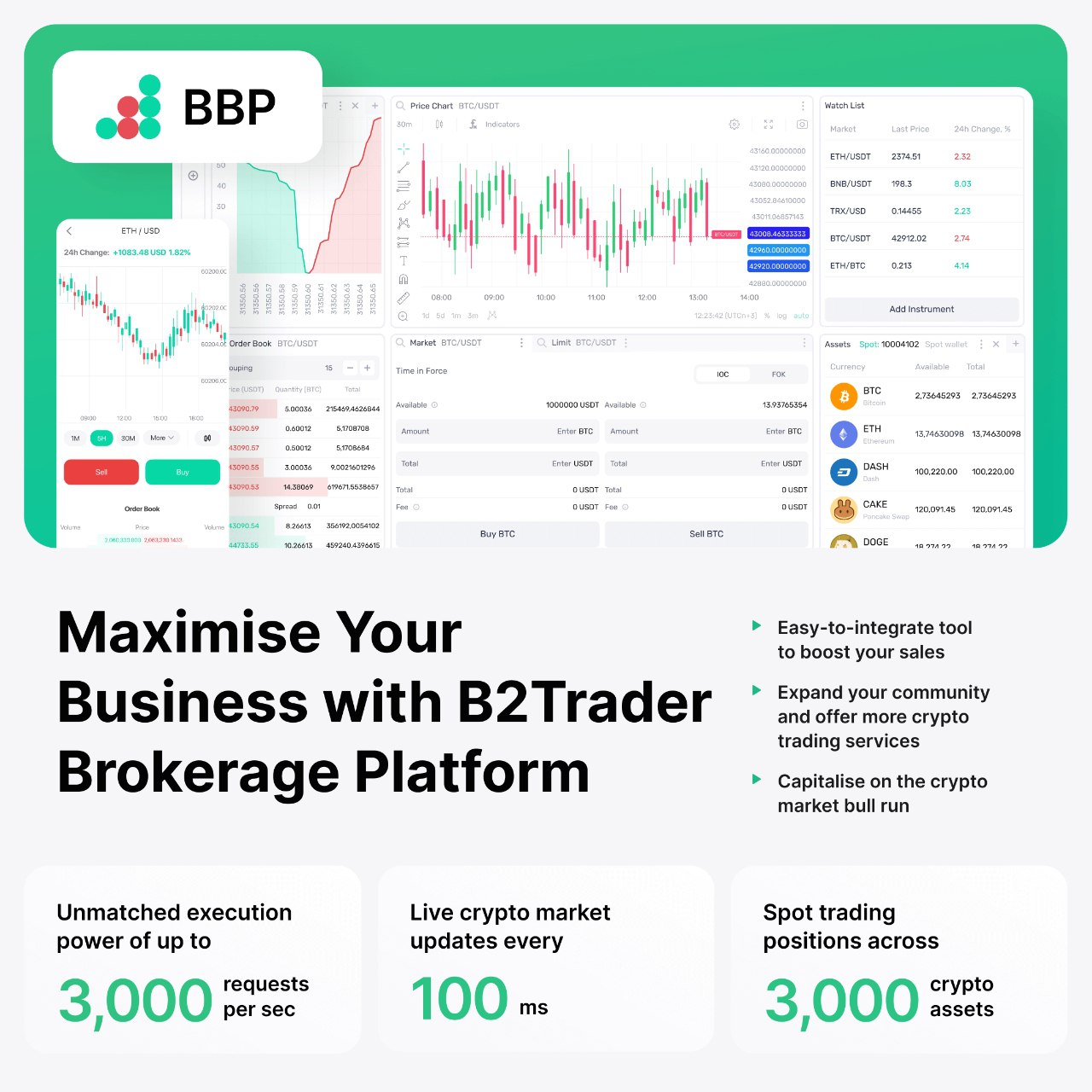

Don't miss your opportunity to launch your crypto brokerage! 🚀

With over 300 million crypto traders worldwide, @B2Broker with the B2Trader Brokerage Platform offers a seamless way for new businesses and established companies to thrive in the booming market. 📈

Why Choose B2Trader? 👀

1️⃣ Boost sales with our easy-to-integrate tools

2️⃣ Expand your services and community in the crypto trading realm

3️⃣ Capitalize on the market's bull run with enterprise solutions

Platform Highlights:

✅ Process 3000 transactions per second

✅ Trade across 3000+ crypto instruments

✅ Enjoy real-time market feeds refreshed every 100ms

Plus, dive into:

📱 User-friendly Trading Interface, CRM, and back-office solutions

💼 Secure blockchain wallets & an efficient management system for automatic payouts

🔐 Comprehensive mobile apps, REST and FIX API protocols, and advanced White Label options

Additionally, leverage renowned platforms:

Integrate with trading platforms like MT4, MT5, and cTrader for a broad range of trading functionalities, enhancing your brokerage services and offering your clients the best trading experiences.

Launch your crypto business with B2Trader, your trusted technology provider 🚀

Ko'proq ko'rsatish ...

123 373

3

Nusxalangan!

💰 BlackRock’s spot Bitcoin ETF amasses 250,000 BTC as Fidelity’s crosses $10 billion AUM

BlackRock’s IBIT spot Bitcoin exchange-traded fund crossed 250,000 ($17.7 billion) in assets under management on Wednesday, just 11 weeks after trading began on Jan. 11. BlackRock’s Bitcoin ETF had already accumulated 245,951 BTC as of Tuesday, according to its latest fund disclosures. IBIT’s $323.8 million (4,702 BTC) worth of net inflows yesterday, per BitMEX Research data, were enough to tip it over the milestone.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

994

2

Nusxalangan!

💰 Bitcoin ETFs break trend recording modest inflows as GBTC continues outflow

According to data from BitMEX, the Bitcoin (BTC) ETF market experienced its first day of net inflows since March 15, collecting a modest $15.7 million, or 221.2 Bitcoin. This event paused five consecutive days of net outflows and represented the second-smallest day of inflows recorded. Despite this positive shift, the larger narrative remained overshadowed by the substantial outflows from GBTC, which amounted to $350.1 million or 4,933.7 BTC. Consequently, GBTC’s cumulative outflows have reached $14,150.6 billion, equivalent to 275,059 BTC.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

2 112

7

Nusxalangan!

💰 Bitcoin ETFs break trend recording modest inflows as GBTC continues outflow

According to data from BitMEX, the Bitcoin (BTC) ETF market experienced its first day of net inflows since March 15, collecting a modest $15.7 million, or 221.2 Bitcoin. This event paused five consecutive days of net outflows and represented the second-smallest day of inflows recorded. Despite this positive shift, the larger narrative remained overshadowed by the substantial outflows from GBTC, which amounted to $350.1 million or 4,933.7 BTC. Consequently, GBTC’s cumulative outflows have reached $14,150.6 billion, equivalent to 275,059 BTC.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

137

1

Nusxalangan!

💰 London Stock Exchange sets May 28 launch date for Bitcoin, Ethereum ETNs

The London Stock Exchange said in a March 25 notice that it plans for Bitcoin (BTC) and Ethereum (ETH) crypto exchange-traded notes (ETNs) to begin trading on May 28. The latest announcement also details other key dates. The London Stock Exchange will begin accepting applications for admission from issuers on April 8. The FCA must also decide on base prospectuses that intend to launch on the first day of trading by May 22.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

894

7

Nusxalangan!

💰 Michael Saylor telling journalist Laura Shin Bitcoin is going up "forever" 3 years ago

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

ssstwitter.com_1711074280004.mp4

94 841

23

Nusxalangan!

💰 BlackRock: “Bitcoin Overwhelmingly Number One Priority for Investors”

BlackRock’s journey into the world of Bitcoin began as early as 2016, marking a multi-year evolution in strategy and outlook. Robert Mitchnick highlights the growing interest among BlackRock’s clients in gaining exposure to Bitcoin, with a notable focus on the iShares Bitcoin Trust (IBIT) ETF managed by BlackRock. However, demand for other digital assets remains minimal, with Mitchnick stating, For every other digital asset, demand is “very, very little.”

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

121 174

5

Nusxalangan!

💰 “I see a rotation out of the $150 Trillion of stocks and bonds, into Bitcoin, alongside money market funds…and that gets Bitcoin to $300K.”

- Nik Bhatia

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

ssstwitter.com_1711073591921.mp4

81 443

8

Nusxalangan!

💰 Bitcoin bearish bias remains strong

Bitcoin’s (BTC) attempt to recover and reclaim its all-time high above $73,000 is facing hurdles, with the asset currently trading below the $70,000 mark amid anticipation ahead of the halving event. Recent price movements have led to Bitcoin’s bearish price predictions, with a section of the market suggesting the outlook is part of the pre-halving retrace. For instance, cryptocurrency trading expert Alan Santana, in a TradingView post on March 23, warned investors to brace for a sell-off, noting that Bitcoin’s bearish bias remains strong.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

75 730

4

Nusxalangan!

⚡️⚡️⚡️⚡️⚡️⚡️ Self-custody is now illegal in EUROPE !

Any cash payment above €10,000 will become illegal, while also anonymous cash payments above €3,000.

Payments made in cryptocurrencies will be prohibited through unidentified wallets. This includes any self-custody wallet provided by mobile, desktop, or browser applications.🤝 @Cryptocurrency_Inside ✅

94 604

33

Nusxalangan!

💰 Cathie Wood doubles down on $1.5 million Bitcoin as institutional exposure looms

Ark Invest CEO Cathie Wood said Bitcoin could be worth more than $1.5 million per coin if institutions allocate roughly 5% of their portfolios to the digital asset. The firm’s revised outlook, suggesting a potential surge in Bitcoin’s price beyond the $1.5 million mark, aligns with broader expectations for its integration into the global financial system. With major financial institutions yet to fully embrace Bitcoin, Wood anticipates further upward momentum in its value.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

116 405

27

Nusxalangan!

JUST IN: 💰 Benchmark senior research analyst tells Yahoo Finance Bitcoin usually rises "for around 18 months" after the halving 🚀

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

ssstwitter.com_1711057028221.mp4

54 423

1

Nusxalangan!

💰 $30 Billion RIA platform Carson Group Vice President reveals they are seeing advisors allocate 3.5% of client households to spot Bitcoin ETFs

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

ssstwitter.com_1710793517761.mp4

74 776

3

Nusxalangan!

💰 Bitcoin Halving May Have a Positive Impact on Prices, But Other Factors Still at Play: Coinbase

Historical precedent suggests that bitcoin’s (BTC) recent strong performance will continue into and after the upcoming halving, as the event reduces the supply of new BTC, but investors should be wary of this view, Coinbase (COIN) said in a research report on Wednesday. The world’s largest cryptocurrency rose an average of 61% in the six months before prior halvings and gained an average of 348% in the six months after, Coinbase noted.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

76 378

7

Nusxalangan!

💰 Marathon CEO explains the financials of landfill methane gas Bitcoin mining ⛏

“With methane landfill gas, it’s coming out of the ground all the time, so you can mine 24/7.”

- Fred Thiel

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

ssstwitter.com_1710941801606.mp4

97 468

11

Nusxalangan!

🥇 Bitcoin halving event now just a month away, expected to occur on 4/20

Bitcoin’s next halving event is now just a calendar month away with approximately 4,450 blocks to go, according to estimates from The Block’s Bitcoin Halving Countdown page. The estimated countdown is based on Bitcoin's average block generation time of 10 minutes, setting a potential date of April 20 at around 8 a.m. EDT at the current pace. Bitcoin’s next halving event will see the reward for miners on the network drop from 6.25 BTC to 3.125 BTC per block.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

87 328

7

Nusxalangan!

💰 GBTC Experiences Its Largest Daily Drain Yet, Nearly 239,000 BTC Gone in Under 70 Days

According to the latest statistics, Grayscale’s Bitcoin Trust (GBTC) experienced its most significant outflow on March 18, 2024, totaling $643 million. Onchain experts have closely observed GBTC’s activities as a considerable number of bitcoin have been moved out of the trust’s reserves.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

80 354

14

Nusxalangan!

💰 $620 million liquidated as Bitcoin breaks below $64k

The market has weathered $542 million in Bitcoin and crypto liquidations over the past 24 hours as Bitcoin fell below $64,000 for the first time in roughly two weeks. On March 6, Bitcoin wicked down below the mark before continuing upward to record new all-time highs repeatedly. Most liquidations were longs at $454 million, with just $87 million in short liquidations. Bitcoin made up $156 million of the total liquidations, according to Coinglass, as of press time.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

114 644

5

Nusxalangan!

💰 $100K to $150K — Traders Target Six-Figure Heights With Long-Dated Bitcoin Call Options

Recent data reveals a significant uptick in open interest for bitcoin futures and options across various trading platforms in recent weeks. On Monday, insights from QCP Capital indicated a notable interest in long-term September and December bitcoin calls, aiming for the lofty six-figure price brackets.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

129 605

6

Nusxalangan!

💰 Standard Chartered raises Bitcoin price target to $150,000 by year-end

Standard Chartered Bank has raised its bitcoin price prediction target to $150,000 from its previous estimate of $100,000. "For 2024, given the sharper-than-expected price gains year-to-date, we now see potential for the BTC price to reach the $150,000 level by year-end, up from our previous estimate of $100,000," Standard Chartered Bank analysts led by Geoffrey Kendrick wrote in a report on Monday.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

98 698

5

Nusxalangan!

💰 9 New Bitcoin ETFs Surpass GBTC by Accumulating 450,000 BTC Worth Over $30B

The latest statistics on bitcoin reserves from the nine new spot bitcoin exchange-traded funds (ETFs) reveal they currently possess 453,503.98 bitcoins, valued at approximately $30.29 billion based on the current exchange rates.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

85 671

8

Nusxalangan!

JUST IN: 💰 Vanguard CEO says they will not offer spot Bitcoin ETFs because it's "not a store of value."

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

azqgZ79WFX7UOMtN.mp4

77 224

2

Nusxalangan!

💰 Jack Maller's thoughts on "being late" to understanding Bitcoin

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

ssstwitter.com_1710252173135.mp4

96 306

29

Nusxalangan!

💰 Michael Saylor on Gold vs Fiat vs Bitcoin

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

1_Dq8GegW5qLpNCF.mp4

60 778

7

Nusxalangan!

💰 Bitcoin Brushes $73,794 Peak Before Midday Price Fluctuations

Bitcoin’s valuation experienced a fluctuating day on Thursday, initially dipping below the $70,000 mark at 12:30 p.m. Eastern Time before ascending back above the $70,000 threshold shortly thereafter. In the early hours of Thursday, bitcoin (BTC) reached a new zenith in its price, touching $73,794 momentarily during morning trading sessions. By 2:20 p.m. Eastern Time (ET) on March 14, 2024, BTC was navigating around $70,271 to $70,905 per unit within a 30-minute span.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

88 943

1

Nusxalangan!

🇹🇭 Thai Rule Change Allows Asset Management Funds to Invest in 💰 Bitcoin ETFs

Thailand-based asset management funds can now launch private funds for investing in U.S. spot bitcoin exchange-traded funds (ETFs), according to the country’s securities regulator. The approval of bitcoin ETFs by U.S. regulators has opened opportunities for Thai asset management firms to gain exposure to the premier crypto asset.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

84 735

6

Nusxalangan!

🌐 Join the Top Telegram Crypto News Channel: Cryptocurrency ↪ Inside! 🌐

Discover the latest in crypto:

- 📰 Up-to-Date News: Stay informed with the newest updates.

- 🔗 Onchain Analytics: Gain deep insights from blockchain data.

- 📅 Market Updates & Insights: Keep track of important market trends.

👥 Join Our Active Community: Engage with fellow crypto enthusiasts.

🔗 Join now: @Cryptocurrency_Inside

#CryptoCommunity #Blockchain #CryptoNews #MarketInsights 🚀🌐📈🔗📅

87 073

0

Nusxalangan!

💰 MicroStrategy looks to raise another $500 million via debt to buy more ‘apex property’

MicroStrategy is looking to raise another $500 million via a bond offering to continue growing its Bitcoin stash less than a week after completing a similar debt sale, according to a March 13 press release. The latest senior convertible notes come with a March 15, 2031, maturity date and offer investors a semi-annual interest payment. The offering will include an option for an additional $75 million in notes, subject to market conditions and demand.

Source

💰 @BitcoinNews

🔵 @EthereumNews

🍰 @AltcoinNews

⚫️ @TradingNews

⚫️ @MetaverseNews

📊 @StockNews

Ko'proq ko'rsatish ...

94 844

8